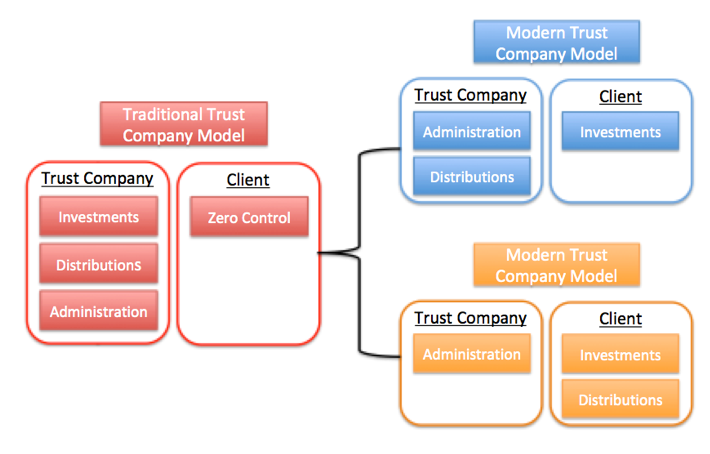

To really understand the benefits of directed trusts, you must first understand the differences between a traditional "delegated" trust and a more modern "directed" trust.

In a traditional trust arrangement, a corporate trustee is responsible for making decisions on investments, distributions, and for the administration of trust assets. All three functions are typically handled in-house. We call this the bundled approach. A trust company may either offer investment management services or delegate investment management to a third party. The trustee still has the ultimate fiduciary responsibility to monitor and oversee the investments and typically will charge a fee based on the market value of the underlying assets, subject to fluctuations in the stock market.

In a directed trust arrangement, the trust document allows for the splitting of trustee duties into multiple roles: an Investment Trustee with the sole discretion to make investment decisions on behalf of the trust, a Distribution Trustee with powers to make or authorize distributions from the trust, and an Administrative Trustee responsible for maintaining books and records and signing tax returns and other documents in an administrative capacity. We call this the unbundled approach. Clients see the value of a corporate trustee for situs, tax, and administration but would prefer to work with their existing professional team of advisors for the investments and perhaps the distribution functions of their trust. A directed trust gives trust grantors, beneficiaries, and their professional advisors more control over a client’s estate plan. Once a cutting-edge planning technique, directed trusts are now the preferred trust structure of the wealthy.

In a directed trust arrangement, the investment management responsibility is removed from the corporate trustee, thus removing the investment liability. This is important because a trustee’s liability for the underlying investments is typically a major factor in determining trustee fees. If the corporate trustee has no investment liability then its fee should be less. Many directed trustees charge a flat fee instead of an asset-based fee to administer a directed trust because of this reduced overall liability.

Given the option, most clients would like to determine what their trust can buy, sell, and hold. They want an advisor they know and trust to manage their investments. They see the value in a corporate trustee administering their trust, but they want the expertise of their trusted financial professionals along the way. Wealthy clients also have nontraditional assets such as, closely-held businesses, family limited partnerships, LLCs, private equity interests, etc., which may not fit under a corporate trustee’s investment parameters. A directed trust allows clients to preserve, protect, and grow these unique assets that are core components to their family’s financial success.

“The task is not to control the wind, but to direct the movements of the ship so that it stays on course.”

Wealthy clients are used to controlling their destiny. They are the captain of their ship, and they like it that way. In estate planning, clients must be willing to give up some level of control, but to the extent they can retain as much as possible, they would prefer it that way. We have discussed giving the client or their trusted financial professional investment discretion in their trust, but some clients also want to give a family member or committee the power to authorize distributions from the trust. They feel this would give more peace of mind and protection for their beneficiaries with fewer restrictions. In a directed trust, they can do just that. The distribution trustee or distribution committee will be able to direct the corporate trustee on when to make a distribution from the trust to a beneficiary.

Nevada has one of the most powerful directed trust statutes in the country. NRS 163.

If you have any questions about directed trusts, please email info@icontrustnv.com or call 702-998-3700.