The easiest way to provide trust services is to partner with an independent advisor-friendly corporate trustee in a tax-favorable jurisdiction that focuses exclusively on the administration of trusts. IconTrust, LLC (ICON) can fill that role. ICON is a Nevada Chartered advisor-friendly trust company. Advisor-Friendly means the trust company does not manage investments, draft trusts, or prepare tax returns. ICON’s role is to administer trusts in coordination with a client’s existing professional team. If ICON has investment discretion within a trust document, ICON will typically delegate that role to the client’s existing financial advisor.

The advisor must feel secure with the advisor-friendly trust company, its business model, and its procedures. The advisor must feel confident with the trust company’s brand and the customer service provided by its trust officers. At the end of the day, the advisor’s client is a client of the trust company, and the advisor is hired by the trust company to provide investment management. The trust company must do nothing to jeopardize the relationship between the advisor and the advisor’s client, only enhance it.

Financial advisors who want to broaden their client relationships to offer trust services under an extension of their existing brand may be interested in a private label trust services relationship (PLT). A PLT relationship is established with a comprehensive PLT Services Agreement between the financial advisor and an existing trust company. The financial advisor will receive a brand name for their private label trust services, e.g., PWM Trust Services, and branded client statements. The financial advisor will typically pay a one-time setup fee to establish the PLT relationship and a revenue share can be created with the trust company. The trust company, for example, ICON, retains all fiduciary liability and must sign off on all marketing materials for the financial advisor’s private label. A separate phone number is issued by ICON in the name of your private label brand. A representative of the PLT partner and a representative of the trust company will work together to provide ongoing training and marketing support.

The private label is a middle ground between referring to an advisor-friendly trust company and starting your own trust company.

Some financial advisors are not comfortable with giving up a level of control in a partnership with an independent advisor-friendly trust company and would rather go through the rigorous process of starting their own trust company. These firms must be comfortable with setting aside capital, hiring trust officers, creating the corporate and compliance framework, and assuming 100% of the fiduciary liability.

A trust company can be chartered by a particular State or by the Office of the Comptroller of the Currency (OCC). Whether chartered by a particular state or by the OCC, a trust company would typically be subject to certain capital requirements, require a fidelity bond and/or E&O insurance, along with complying with BSA/AML standards like most other financial institutions. For example, in Nevada, the capital requirement is $1M, and a physical office in Nevada staffed with a trust officer is required. Further, a chartered trust company in Nevada will typically need another $500k - $1M in operating capital.

Most “family office” trust companies are state-chartered and are established under one of the top four trust jurisdictions (NV, SD, DE, AK). These states are typically business-friendly, have no state personal or corporate income tax, possess the top assets protection statutes, and permit the use of Dynasty Trusts to last several generations.

The barrier to entry in the four top jurisdictions is very similar and an advisor must make sure they want to assume the financial risk and liability associated with starting a trust company. Profitability can be elusive, possibly taking several years.

Financial advisors have been successfully implementing each of these options in providing trust services to their clients. One choice is not better than the others. The advisor must decide how important their brand is when working with their trust clients and how much control they want over the trustee relationship. Partnering with an advisor-friendly trust company, starting a trust company, or creating a private label arrangement all solidify client relationships across multiple generations.

If you have any questions about a referral or private label trust relationship with ICON, please email info@icontrustnv.com or call 702-998-3700.

The America’s Most Advisor Friendly Trust Companies guide was released this week by The Wealth Advisor, a leading voice in the financial services industry. This guide details 21 of the best non-custodial, non-management trust companies in the industry. IconTrust is the newest company on the list.

To view our profile or download the full guide click below.

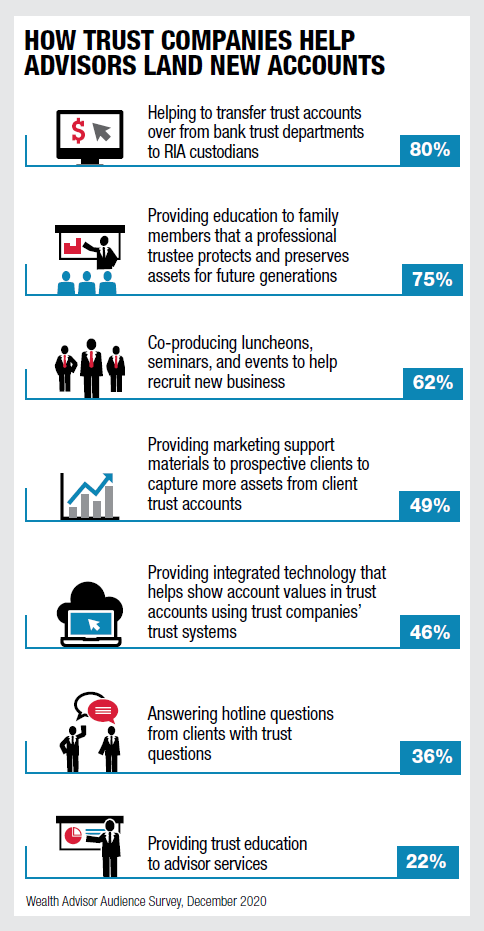

The trust companies on this list partner with advisors instead of competing for assets under management. They realize that investment management is best provided by the client's trusted financial advisor and trust administration is best provided by an independent corporate trustee. This is in stark contrast to the traditional trust companies of the past that handle both sides; trust administration and investment management. Many clients prefer the separation of duties, flat trustee fees, and the greater flexibility of an advisor-friendly trust company.

"A trust account is an investment account with instructions. You handle the investment account, we handle the instructions."

The average consumer is smarter than ever before and knows that investment management can sometimes be a bit of a commodity. They are reminded of computer-based platforms that can supposedly match market returns for a fraction of the price of a financial advisor. This is why managing trust accounts is such a differentiator in the marketplace. Providing trust services goes beyond asset management and into deep conversations about legacy planning and family dynamics that can solidify advisor relationships for many generations. Trust assets are sticky and working with an advisor-friendly trust company is a financial advisor’s glue to the next generation.

With a new political administration and a potential of a decrease in the estate tax exemption, wealthy families will need estate tax planning advice in 2021 and beyond. For advisors, there has never been a more opportune time to partner with a law firm and an advisor-friendly trust company to offer estate planning services. Advisors who are proactive in providing advice in this potential new tax environment are poised to attract many new wealthy families to their business.

IconTrust was founded in 2020 and is the newest trust company to the list of America’s Most Advisor Friendly Trust Companies. Years of experience in an outdated and archaic trust industry prompted us to create a new model for advisors and their clients. We think charging trustee fees based on assets under administration is outdated. Our flat trustee fees for all types of trusts are easier for advisors to promote and for clients to understand.

We feel our flat fee schedule for all trust services is a true differentiator in the marketplace. We built IconTrust with simple procedures and simplified fees that everyone can understand. We believe our model will set a new standard for how a modern trust company should operate and provide services to advisors and their clients.

To learn more about Icon's Benefits for Financial Advisors contact us at 702-998-3700 or email info@icontrustnv.com.

A trust settlement checklist is a must-have if you have been named as successor trustee on a trust. After the death of an individual, their estate plan needs to be administered. This process is called post-mortem administration and is a series of tasks performed by a fiduciary named in the estate planning documents. The fiduciary of a trust is called a successor trustee.

Serving as the successor trustee of a trust is not a role to be taken lightly. Administration can be an arduous and time-intensive project even for a professional trustee, let alone an individual trustee who may not be familiar with the fiduciary duties and liabilities they are undertaking. If you have been named as successor trustee on a trust, the following checklist may serve as a guide of some of the duties you may perform in settling the trust and carrying out the wishes of the decedent.

If you have any questions about the above trust settlement checklist, please email info@icontrustnv.com or call 702-998-3700.

A corporate trustee is a bank or independent trust company that is licensed to act as trustee of a trust.

The primary function of a trustee is to administer trust assets according to the grantor’s wishes while considering the interests of the beneficiaries of the trust.

In a traditional trustee arrangement, one trustee wears all three hats. The trustee is responsible for the investments, distributions, and administration of the trust. Thankfully, over the last twenty-five years, many states have amended their laws to allow for the splitting of trustee duties, commonly referred to as a directed trust arrangement. This arrangement allows for the bifurcation or trifurcation of trustee duties giving trust grantors, beneficiaries, and their professional advisors more control over a client’s estate plan. Grantors can now decide which hats they want their trustee(s) to wear and what powers they retain. The grantor can select one sole trustee with full powers, or multiple trustees to wear different hats and retain only certain powers.

Irrevocable Trusts

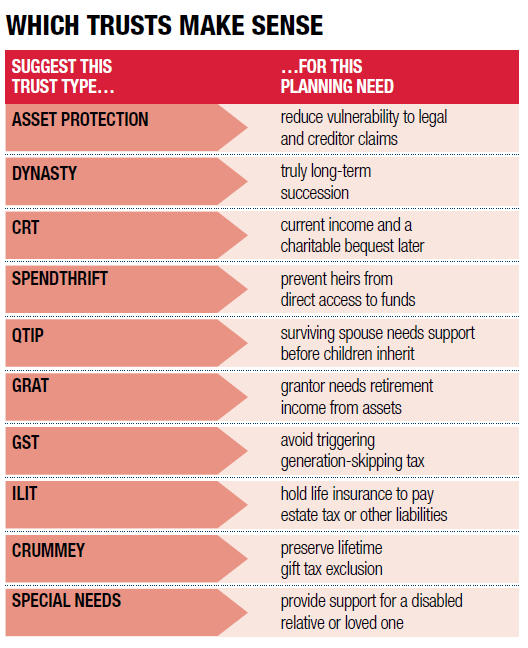

If you are setting up an irrevocable trust while you are alive, you will need a trustee to act today. Some of the reasons you might set up an irrevocable trust are for asset protection, gifting, estate tax planning, income tax planning, charitable planning, opportunity shifting, etc. You will need to separate yourself from the assets and having a trustee in a top trust jurisdiction can be to your benefit for state income tax savings and asset protection.

Revocable Trusts

There are many factors to consider if you have a revocable living trust and are looking for a successor trustee to take over in the event you become incapacitated or pass away. Please look at the following chart to determine whether a family member or a corporate trustee makes the most sense within your estate plan.

| Individual | Corporate Trustee | Advantage | |

| Experience | Do they have experience serving as a trustee? Do they know the responsibility & liability of serving? Do they want to serve? | Has Trust Officers trained in trust administration with expertise in record-keeping, tax and trust law. | Corporate Trustee |

| Time / Resources | Do they have the time required to administer a trust? Do they have the appropriate resources? | Has a full-time dedicated staff and a network of estate planning professionals. | Corporate Trustee |

| Cost | Has the discretion to charge a fee, usually drafted into the trust document, or determined by state statute. | Should have a published fee schedule on their website. Usually more expensive than an individual trustee. | Individual Trustee |

| Knowledge of the Family | May have more intimate knowledge of the grantor, his or her wishes, and the beneficiaries | May have less intimate knowledge of the grantor, his or her wishes, and the beneficiaries. | Individual Trustee |

| Impartiality / Objectivity | Biased. It is very difficult for individuals to not show biases during trust administration. Can they make difficult decisions without emotion, strictly based on the trust provisions? | Unbiased. They can only do what the trust document tells them to do. They are not affected by emotion and have the appropriate tools to make difficult decisions. | Corporate Trustee |

| Location for state income taxes | Do they live in a state with a state income tax or a creditor friendly jurisdiction? | Does the corporate trustee reside in a favorable jurisdiction like Nevada for tax and creditor protection? | Corporate Trustee |

| Continuity | What is their age? | Corporate trustees continue in perpetuity. | Corporate Trustee |

| Removal process | Will they resign if asked by the beneficiaries? | Run a business and will typically resign if asked by the beneficiaries. | Even |

| Regulated / Insured | Not regulated. | Financially stable and carry insurance to protect the beneficiaries. | Corporate Trustee |

For more information please give us a call at 702-998-3700 or email info@icontrustnv.com