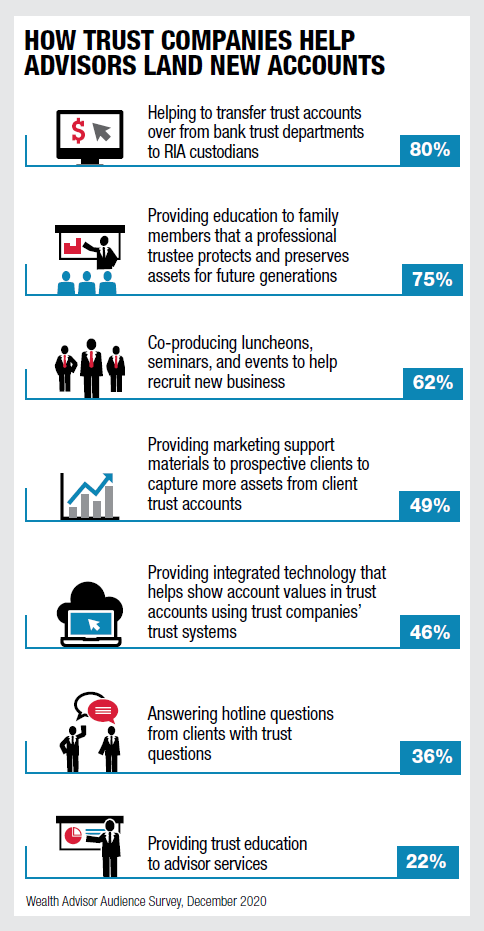

The America’s Most Advisor Friendly Trust Companies guide was released this week by The Wealth Advisor, a leading voice in the financial services industry. This guide details 21 of the best non-custodial, non-management trust companies in the industry. IconTrust is the newest company on the list.

To view our profile or download the full guide click below.

The trust companies on this list partner with advisors instead of competing for assets under management. They realize that investment management is best provided by the client's trusted financial advisor and trust administration is best provided by an independent corporate trustee. This is in stark contrast to the traditional trust companies of the past that handle both sides; trust administration and investment management. Many clients prefer the separation of duties, flat trustee fees, and the greater flexibility of an advisor-friendly trust company.

"A trust account is an investment account with instructions. You handle the investment account, we handle the instructions."

The average consumer is smarter than ever before and knows that investment management can sometimes be a bit of a commodity. They are reminded of computer-based platforms that can supposedly match market returns for a fraction of the price of a financial advisor. This is why managing trust accounts is such a differentiator in the marketplace. Providing trust services goes beyond asset management and into deep conversations about legacy planning and family dynamics that can solidify advisor relationships for many generations. Trust assets are sticky and working with an advisor-friendly trust company is a financial advisor’s glue to the next generation.

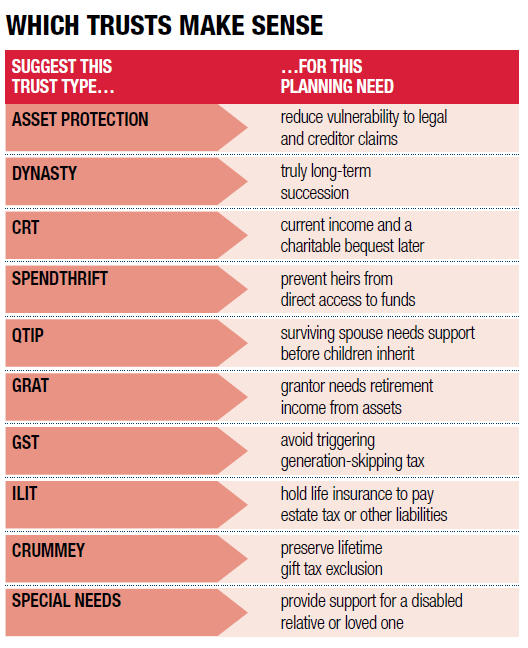

With a new political administration and a potential of a decrease in the estate tax exemption, wealthy families will need estate tax planning advice in 2021 and beyond. For advisors, there has never been a more opportune time to partner with a law firm and an advisor-friendly trust company to offer estate planning services. Advisors who are proactive in providing advice in this potential new tax environment are poised to attract many new wealthy families to their business.

IconTrust was founded in 2020 and is the newest trust company to the list of America’s Most Advisor Friendly Trust Companies. Years of experience in an outdated and archaic trust industry prompted us to create a new model for advisors and their clients. We think charging trustee fees based on assets under administration is outdated. Our flat trustee fees for all types of trusts are easier for advisors to promote and for clients to understand.

We feel our flat fee schedule for all trust services is a true differentiator in the marketplace. We built IconTrust with simple procedures and simplified fees that everyone can understand. We believe our model will set a new standard for how a modern trust company should operate and provide services to advisors and their clients.

To learn more about Icon's Benefits for Financial Advisors contact us at 702-998-3700 or email info@icontrustnv.com.

A trust settlement checklist is a must-have if you have been named as successor trustee on a trust. After the death of an individual, their estate plan needs to be administered. This process is called post-mortem administration and is a series of tasks performed by a fiduciary named in the estate planning documents. The fiduciary of a trust is called a successor trustee.

Serving as the successor trustee of a trust is not a role to be taken lightly. Administration can be an arduous and time-intensive project even for a professional trustee, let alone an individual trustee who may not be familiar with the fiduciary duties and liabilities they are undertaking. If you have been named as successor trustee on a trust, the following checklist may serve as a guide of some of the duties you may perform in settling the trust and carrying out the wishes of the decedent.

If you have any questions about the above trust settlement checklist, please email info@icontrustnv.com or call 702-998-3700.